An important month for me, as i start to obtain a kind of consistency in my trading. 172 trades in total (86x2 lots), 88 winners, 40 losers, 44 nulls (0-2 pips). Win /loss ratio is the best so far at 2,2, while the reward/risk ratio dropped again (I still let some losers run). The improved w/l with bigger lots gave this 21,59% performance.

An important month for me, as i start to obtain a kind of consistency in my trading. 172 trades in total (86x2 lots), 88 winners, 40 losers, 44 nulls (0-2 pips). Win /loss ratio is the best so far at 2,2, while the reward/risk ratio dropped again (I still let some losers run). The improved w/l with bigger lots gave this 21,59% performance.

Monday, March 31, 2008

Monthly Stats : March 2008

An important month for me, as i start to obtain a kind of consistency in my trading. 172 trades in total (86x2 lots), 88 winners, 40 losers, 44 nulls (0-2 pips). Win /loss ratio is the best so far at 2,2, while the reward/risk ratio dropped again (I still let some losers run). The improved w/l with bigger lots gave this 21,59% performance.

An important month for me, as i start to obtain a kind of consistency in my trading. 172 trades in total (86x2 lots), 88 winners, 40 losers, 44 nulls (0-2 pips). Win /loss ratio is the best so far at 2,2, while the reward/risk ratio dropped again (I still let some losers run). The improved w/l with bigger lots gave this 21,59% performance.

Labels:

forex,

performance stats

Friday, March 28, 2008

Thursday, March 27, 2008

Friday, March 21, 2008

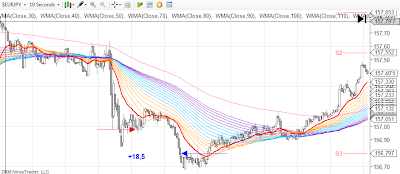

The best of two worlds

Not a boring day yesterday : 300 pips down, then more than 100 up. I made 70 (35 x 2 lots) out of this in 4-5 hours of trading and 22 trades (11x2). As I noted today these trades on the charts on the left, I was really surprised when I saw how early I close winning trades. All signs were there to confirm a strong movement : slope of the rainbow, separation of WMAs etc. My fear to see a (barely) positive trade to turn to negative forces me to stop the winners. I cannot let the profits run yet.

Not a boring day yesterday : 300 pips down, then more than 100 up. I made 70 (35 x 2 lots) out of this in 4-5 hours of trading and 22 trades (11x2). As I noted today these trades on the charts on the left, I was really surprised when I saw how early I close winning trades. All signs were there to confirm a strong movement : slope of the rainbow, separation of WMAs etc. My fear to see a (barely) positive trade to turn to negative forces me to stop the winners. I cannot let the profits run yet.

I could let at least one lot to follow the trend with stoploss at break even. This is the way to keep the best of two worlds : very fast movements and small gains (scalping) and larger and bigger ones (intraday trading).

Labels:

forex,

trade analysis

Thursday, March 20, 2008

Trading in the range

This a typical example of impatient trading. I shorted while price was above previous low and rainbow all messed up. As a consequence, I took the bounce and exited with -10p. Re-entered by revenge, took an other -12 or so, not closed, price then dropped again and I closed as soon I got back the 10 pips. This closing point is precisely the correct place to short the market, the break of the range...

This a typical example of impatient trading. I shorted while price was above previous low and rainbow all messed up. As a consequence, I took the bounce and exited with -10p. Re-entered by revenge, took an other -12 or so, not closed, price then dropped again and I closed as soon I got back the 10 pips. This closing point is precisely the correct place to short the market, the break of the range...

Labels:

forex,

trade analysis

Tuesday, March 18, 2008

Post FOMC : Risky business

Risky post-FOMC entry, in the direction of the first movement (down): I risked 23 pips to make 25. Closed just in time before the huge reversal....

Risky post-FOMC entry, in the direction of the first movement (down): I risked 23 pips to make 25. Closed just in time before the huge reversal....

Labels:

forex,

trade analysis

Sunday, March 16, 2008

Weekly stats : Week 18 (10-14/3)

The mistake described in a previous post had his effect on the average loss and R/R ratio. Because of this, weekly performance remained low, despite the better W/L ratio this week.

The mistake described in a previous post had his effect on the average loss and R/R ratio. Because of this, weekly performance remained low, despite the better W/L ratio this week.

Labels:

forex,

performance stats

Friday, March 14, 2008

Early exit

7 pips taken on this spotted top, or price exhaustion. The question is why I exited so early. The fear and stress I felt this afternoon., is the answer (see previous post). I could close one lot and let the other run with stoploss at B/E. This is the only way to have a Reward/Risk ratio bigger than 1. Elementary, my dear Watson.

7 pips taken on this spotted top, or price exhaustion. The question is why I exited so early. The fear and stress I felt this afternoon., is the answer (see previous post). I could close one lot and let the other run with stoploss at B/E. This is the only way to have a Reward/Risk ratio bigger than 1. Elementary, my dear Watson.

Labels:

forex,

trade analysis

Crime and punishment

Before the trades described here, i was positive +4,25% for the day and 11.60% for the week. BUT the good results made me arrogant, i was more clever than the markets again. I entered long, market turned immediately against me, -10, -20, -30, -40 pips, trade not closed... But later on, the market was so generous with the poor ignorant, to offer me 4 times the occasion to close at break even. Occasion was ignored of course. Then price started to drop significally and after 3 dramatic hours I decided to close at -47,5. Good decision indeed, the big drop was just beginning.

Before the trades described here, i was positive +4,25% for the day and 11.60% for the week. BUT the good results made me arrogant, i was more clever than the markets again. I entered long, market turned immediately against me, -10, -20, -30, -40 pips, trade not closed... But later on, the market was so generous with the poor ignorant, to offer me 4 times the occasion to close at break even. Occasion was ignored of course. Then price started to drop significally and after 3 dramatic hours I decided to close at -47,5. Good decision indeed, the big drop was just beginning.I entered then in the correct direction and took one third of the pips back.

My problem : I pretend to be a scalper and once a week or a month, I behave as a position trader, losing my gains from scalping! I can't afford the large stop losses of a position trader.

Weekly profits ruined because of this trade. Week closed slightly positive.

Labels:

forex,

trade analysis,

trades : the ugly ones

Take a few pips and RUN!

Entered long when the previous high was taken but I exited immediately as CCI 14 on 1min gave lower high. 8,5 pips, not bad.

Entered long when the previous high was taken but I exited immediately as CCI 14 on 1min gave lower high. 8,5 pips, not bad.

Labels:

forex,

trade analysis

Wednesday, March 12, 2008

Support and resistance

I didn't trade this but, from my experience, a break that happens AFTER support on a previous resistance line is safe to enter.In addition, price moves away from the rainbow.

I didn't trade this but, from my experience, a break that happens AFTER support on a previous resistance line is safe to enter.In addition, price moves away from the rainbow.

Labels:

forex,

trade analysis

7,5 pips

7,5 pips won in london session. There was a relatively safe entry long after this, I didn't take it and missed the party.

7,5 pips won in london session. There was a relatively safe entry long after this, I didn't take it and missed the party.

Labels:

forex,

trade analysis

Saturday, March 8, 2008

Friday, March 7, 2008

Wednesday, March 5, 2008

Ma connerie habituelle

Entered a choppy market whithout stoploss. The pair changed direction immediately after and forced me to close in catastrophy at the top of retracement. Result :-35 pips!...

Entered a choppy market whithout stoploss. The pair changed direction immediately after and forced me to close in catastrophy at the top of retracement. Result :-35 pips!...

Labels:

forex,

trade analysis,

trades : the ugly ones

Saturday, March 1, 2008

Monthly stats : February

This month I won almost half the pips of those of January BUT the simple fact that the number of Feb trades is also half comparing to previous month, gave a positive monthly result! (3,92%) (much less commissions paid). I can't find better argument against ovetrading. Trades per day contained at 11,8 (double lots as always). Average loss below 10 pips for the first time.

This month I won almost half the pips of those of January BUT the simple fact that the number of Feb trades is also half comparing to previous month, gave a positive monthly result! (3,92%) (much less commissions paid). I can't find better argument against ovetrading. Trades per day contained at 11,8 (double lots as always). Average loss below 10 pips for the first time.

Labels:

forex,

performance stats

Weekly Stats : Week 15 (25-29/2)

40 trades in 4 days this ending week and smaller lots traded. A week quite similar to the previous one but reward/risk ratio has decreased.

40 trades in 4 days this ending week and smaller lots traded. A week quite similar to the previous one but reward/risk ratio has decreased.

Labels:

forex,

performance stats

Subscribe to:

Posts (Atom)

++9_10_2012.png)