Sunday, October 31, 2010

If you love me

Back home, after a splendid week in France. I was listening to new cds, late in the night in the hotel room, while the family was sleeping. Among these, a masterpiece : the biggest accordionist of our time, the French Richard Galliano meets the best vibraphonist, Gary Burton, in a superb duet. Piazzola transported in Europe, with spirit, intelligence and sensibility. A must have cd.

Labels:

music

Friday, October 22, 2010

Only a few

Only these three for today. Preparing for a 7-days trip to France with family.Hope we will not blocked there because of the strikes.. So no trades next week, as I never trade via an unsecure hotel connection.

Labels:

forex,

trade analysis

Thursday, October 21, 2010

Wednesday, October 20, 2010

Late entry

Late entry on the second trade and only a few pips gain as a consequence and, more important, a risky third trade.

Labels:

forex,

trade analysis

Tuesday, October 19, 2010

Friday, October 15, 2010

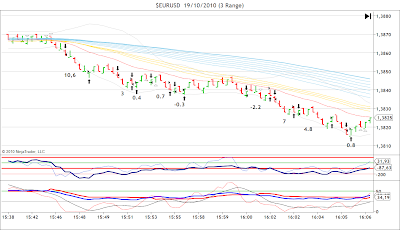

Overtrading

My 5' clock session. Two good trades and then five unnecessary ones. I had all the pips i needed and then I continued, to follow price further down. Consolidation gave minor losses and more conmmission expenses.

The only ennemy of my method is named overtrading. Overtrading means gambling attitude. The ennemy is inside me.

The only ennemy of my method is named overtrading. Overtrading means gambling attitude. The ennemy is inside me.

Labels:

forex,

trade analysis

Thursday, October 14, 2010

Hesitation

A good start of session and a mediocre finish. The 4,4 pips trade was late entry, due to my hesitation. The last one was impulsive, closed in time..

Labels:

forex,

trade analysis

Wednesday, October 13, 2010

Tuesday, October 12, 2010

Post-FOMC

The trend was strong but this is easier to confirm afterwards. When in action, and because I trade with big lots, I prefer to have tight stops and multiple entries/exits. High volatility means also deep retracements. I can't afford to go long and then get a retracement of 40 pips in the face, praying for the price to go up again. Act like a sparrow: one little piece at a time, again and again.

Labels:

forex,

trade analysis

Friday, October 8, 2010

Post-NFP

One loss while in the range and then the big shot, on the move down . Followed by two additional moves. The entry on the third was terribly late and as a result the trade became vulnerable and was saved in extremis from a big loss, as the violent correction came immediately after my exit.

Labels:

forex,

trade analysis

Thursday, October 7, 2010

Wednesday, October 6, 2010

Tuesday, October 5, 2010

Don't play with a strong trend

Four of these many trades were contra-trend. Three of them gave small but unnecessary losses. Anticipating a correction on a strong trend is the shortest way to perdition.

Labels:

forex,

trade analysis

Friday, October 1, 2010

Subscribe to:

Posts (Atom)