Wednesday, June 30, 2010

Tuesday, June 29, 2010

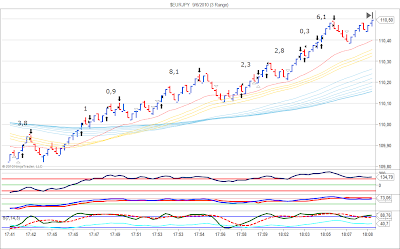

A nice move

When price moves straight up or down, my cautious (manually) trailing stop is not triggered and the gain is considerable.

Labels:

forex,

trade analysis

Monday, June 28, 2010

Same scenario

3 little winners again today, an almost identical setup with the one of previous post. No more than 3 trades on the same move, as the correction becomes more and more probable. If you trade with relatively big lots, you don't need more than 12 pips daily.Time to enjoy the evening now..

Labels:

forex,

trade analysis

Friday, June 25, 2010

Wednesday, June 23, 2010

Thursday, June 17, 2010

Bad day

I have my moments of stupidity when trading, rather less frequently now than in the past. My own symptom of stupidity attack, is the prediction euforia. On these moments I can "predict" where the market is going, i can anticipate on price move. To feel more clever than the markets is the supreme stupidity in this job and the perfect suicide method.

The same mistake twice within minutes today. That means that I am in VERY bad shape and I must stop NOW. The reasons can be several : bad sleep, fatigue, a father in critical condition and so on. But no reason can be an excuse. Better stay aside for a while.

The same mistake twice within minutes today. That means that I am in VERY bad shape and I must stop NOW. The reasons can be several : bad sleep, fatigue, a father in critical condition and so on. But no reason can be an excuse. Better stay aside for a while.

Labels:

forex,

trade analysis,

trades : the ugly ones

Tuesday, June 15, 2010

5 trades

First trade was ok, at the break of long base. Second trade was unnecessary and risky. The third was late and the fourth closed in time.

Labels:

forex,

trade analysis

Sunday, June 13, 2010

Loyal friends

I want to say a big thanks to the unknown friend from Spain (Avila?) who, according to my blog's tracking data, has visited this page 1005 times in the last two years. I hope to have helped you a little in anyway, my friend.. Second is a friend from Vancouver, Canada with 597 visits and third a guy/gal from U.S. with 258 visits.

You (or anybody else) can write about you in the comments, if you wish. Thank you again.

You (or anybody else) can write about you in the comments, if you wish. Thank you again.

Labels:

forex

Wednesday, June 9, 2010

Mistakes last for ever

That was immediately after the previous chart. Buying local tops is a recurring bad attitude. It happens on my bad days, when I am not in shape. I entered long and waited an eternity to turn positive, while price was making several lower highs and lows, a sign of a probable reversal. It went to -10 and moved again to my favor just one pip above my stop. Very lucky indeed and very bad scalping manners!..

Labels:

forex,

trade analysis,

trades : the ugly ones

Splitting a trend

Splitting -again- a trend to several trades when on high lots. Minimizing the risk this way but also the gains. The range of last days does not let me trust the market anymore.

Labels:

forex,

trade analysis

Tuesday, June 8, 2010

Get out and re-enter

For me, the best trade on this chart, is the second one, a loser. I didn't let price to go to -10 (or -40, who knows), I exited early to re-enter on the new tide.

Labels:

forex,

trade analysis

Monday, June 7, 2010

Friday, June 4, 2010

On the road

No trades in the recent days, as I am on a trip and I never trade via the unsecure hotel's connection.

I will try to write here, starting on Sunday, about my new setups, as I promised to my friend Christian (sorry for the delay Christian!)

I will try to write here, starting on Sunday, about my new setups, as I promised to my friend Christian (sorry for the delay Christian!)

Tuesday, June 1, 2010

Late entry

The 10,6 trade was inexcusably late, as the long rectangle was off way before I entered. This kind of reaction not only cuts the gains but also makes the trade a lot more risky..

Labels:

forex,

trade analysis

Subscribe to:

Posts (Atom)

++9_10_2012.png)