Tony Judt was a brilliant British historian who died last August. I started reading his last work, wich was composed while he was totally immobilized by the motor neuron disease that was to lead to his death within a few months of its publication. The book is a touching reminiscence of his life, a testament to his courage and a fitting memorial to a great historian and a wise and humane man. Fascinating reading.

Thursday, December 23, 2010

A book for Christmas

Tony Judt was a brilliant British historian who died last August. I started reading his last work, wich was composed while he was totally immobilized by the motor neuron disease that was to lead to his death within a few months of its publication. The book is a touching reminiscence of his life, a testament to his courage and a fitting memorial to a great historian and a wise and humane man. Fascinating reading.

Labels:

books

Dangerous market

I usually avoid trading during the Christmas period, but today I opened charts again. What I was afraid of, was there : a thin market, violently moved by the big guys, to make extra gains before their vacations. I had a 2,5 pips trade and the market, IMMEDIATELY after this, moved 40 pips in the opposite direction, precisely at the London opening (10:00)!.. I could stay with the long open and no stop and get a -40 on the face in 3 seconds.. I took fastly 11 pips on the right direction but this is gambling, no trading. Got a little more and closed trades for a week at least. Leaving by now.

Merry Christmas, happy Hannukah!

Merry Christmas, happy Hannukah!

Labels:

forex,

trade analysis

Tuesday, December 21, 2010

Flat

Lost some on a perfectly flat, boring pre-Christmas session. I should go packing and leaving for the mountains instead.

Labels:

forex,

trade analysis

Monday, December 20, 2010

5 o'clock

Nice steady move, on a pre-Christmas dull Monday. 32 pips in 12 trades and done for the day. I should learn (in 2011) to have those pips whith fewer trades. I had to exit and re-enter often today, because of the thin market and for maximum seciurity.

Labels:

forex,

trade analysis

Sunday, December 19, 2010

Friday, December 17, 2010

Expectations

A serious mistake here : in the middle of a strong move and after some green bars, I believed it was time for a retracement. I went contra-trend and...I lost 7,6 pips. I had the "honesty" to accept my fault relatively quickly and then I entered in the right direction and got the pips back.

I wrote this a million times before : Our beliefs, expectations, assumptions are the perfect way to perdition, especially when trading. What every zen monk knows very well.

I wrote this a million times before : Our beliefs, expectations, assumptions are the perfect way to perdition, especially when trading. What every zen monk knows very well.

Labels:

forex,

trade analysis,

trades : the ugly ones

Thursday, December 16, 2010

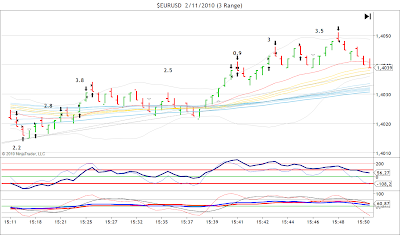

Out of the box

Range bars show ..the range much better than candlesticks. 4,9 easy pips here, just by putting a buy order above the rectangle. BUT, if I wanted more, I would be kicked off with a loss. That is the edge of the scalper : he needs a few pips only, he is modest. Otherwise, he's lost.

Labels:

forex,

setups,

trade analysis

Wednesday, December 15, 2010

Tuesday, December 14, 2010

Monday, December 13, 2010

Same scenario

Same scenario as on the previous fx post : collecting pips when bying ascending supports and getting anxious, having fewer pips, if not losses, when bying breakouts It is very simple, isn't? Some cunning fellows charge you (a lot of) money to teach you this..

Labels:

forex,

trade analysis

Thursday, December 9, 2010

Valery Gergiev

Valery Gergiev conducting the famous Mariinsky Theater Orchestra at the Athens Megaron. I was lucky enough to be in the audience. He gave an astonishing performance of Mahler's 5th Symphony, a big revelation for me, although I have listen to this masterpiece hundreds of times, in the last 30 years... All the tension is in his hands, which are like rubber..On the first part, the exquisite Tchaikovsky's violin concerto, soloist the great Leonidas Kavakos. An unforgettable evening..

Labels:

music

Ascending support vs. breakout

The trades who gave 12,4 and 5,1 pips on this chart were entered when an ascending support (after retracement) was observed, while (almost all of) the rest of the entries were at (local) breakouts. Look how more relaxed and easier are the former.

Labels:

forex,

setups,

trade analysis

Wednesday, December 8, 2010

Greed or addiction?

Some mini-losses inside the range and then a good shot which gave 12,9 pips. Followed by six little trades which totalled -1,5 pips, plus commissions. The session should stop after the mandatory stop to preserve the 12,9 pips gain. Why did I continue?

Labels:

forex,

trade analysis

Tuesday, December 7, 2010

Monday, December 6, 2010

Bloody Monday

A rather easy to trade Monday opening was transformed to a few pips loss. Looks like I lost my fast reflexes during the weekend. On fourth trade for example, a "smart ass" anticipation of reversal costed me 11.8 pips. Silly, silly.

Labels:

forex,

trade analysis,

trades : the ugly ones

Friday, December 3, 2010

Post-NFP (1)

Not much on this first attempt to trade post-NFP. Mainly due to the tight stop loss (my safety net under high volatility conditions).

Labels:

forex,

trade analysis

Before NFP

Usually I don't trade at the London session before NFP announcement. Today was an exception. Volatility was slightly bigger than expected.

Labels:

forex,

trade analysis

Thursday, December 2, 2010

Wednesday, December 1, 2010

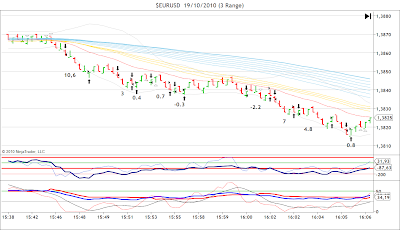

Slices

Getting slices only out of the afternoon move, as I didn't trusted much this downtrend/correction. Ending the day with 39 pips gain in 11 trades, trading significantly less than on the last days of November. I consider this fact a big plus. Don't get hooked. Life is elsewhere. Steve Kuhn on the stereo right now.

Labels:

forex,

trade analysis

Tuesday, November 30, 2010

...and down

Several pips on this, splitted on many trades. Extra safety has a considerable cost in commissions.. I should learn to trust the trend more...

Labels:

forex,

trade analysis

Monday, November 29, 2010

Pre-London

Quick move and some pips just before London opening. I stopped at this point, to avoid the usual Monday morning stagnation.

Labels:

forex,

trade analysis

Thursday, November 25, 2010

Thanksgiving

Today I was expecting a dead market, dead as the poor turkey is.. Despite that, the guys in Europe gave some action and slow, sweet moves.

Labels:

forex,

trade analysis

Wednesday, November 24, 2010

Tuesday, November 23, 2010

The newbie in me

Back to the monitors after several busy days. I opened charts around 10pm, only to see the euro collapse that happened earlier today. I insisted to trade even at this obviously dead hour. The result was some consecutive losses and intense frustration.. A totally unacceptable behavior, given my experience.

Labels:

forex,

trade analysis

Tuesday, November 16, 2010

Thursday, November 11, 2010

Wednesday, November 10, 2010

Tuesday, November 9, 2010

One more chance for the fool

On first trade, the two pillars of catastrophy were there : late entry and refusal to exit with a loss. Price went to -18 and I was just looking at the disaster, like a petrified newbie. Then price recovered to breakeven, trade not closed, and went south again, making a double top. I closed with a -6.8 loss, in extremis, just because the market was kind enough to give me a second chance..The pips came immediately after, when I got the correct direction...

Labels:

forex,

trade analysis,

trades : the ugly ones

Monday, November 8, 2010

Friday, November 5, 2010

Wednesday, November 3, 2010

Post-FOMC

Wild moves after FOMC announcement. Waited for the spread to narrow again and then entered 3 times and then stopped. Extreme volatility can make you lose your mind.

Labels:

forex,

trade analysis

Tuesday, November 2, 2010

Monday, November 1, 2010

Sunday, October 31, 2010

If you love me

Back home, after a splendid week in France. I was listening to new cds, late in the night in the hotel room, while the family was sleeping. Among these, a masterpiece : the biggest accordionist of our time, the French Richard Galliano meets the best vibraphonist, Gary Burton, in a superb duet. Piazzola transported in Europe, with spirit, intelligence and sensibility. A must have cd.

Labels:

music

Friday, October 22, 2010

Only a few

Only these three for today. Preparing for a 7-days trip to France with family.Hope we will not blocked there because of the strikes.. So no trades next week, as I never trade via an unsecure hotel connection.

Labels:

forex,

trade analysis

Thursday, October 21, 2010

Wednesday, October 20, 2010

Late entry

Late entry on the second trade and only a few pips gain as a consequence and, more important, a risky third trade.

Labels:

forex,

trade analysis

Tuesday, October 19, 2010

Friday, October 15, 2010

Overtrading

My 5' clock session. Two good trades and then five unnecessary ones. I had all the pips i needed and then I continued, to follow price further down. Consolidation gave minor losses and more conmmission expenses.

The only ennemy of my method is named overtrading. Overtrading means gambling attitude. The ennemy is inside me.

The only ennemy of my method is named overtrading. Overtrading means gambling attitude. The ennemy is inside me.

Labels:

forex,

trade analysis

Subscribe to:

Posts (Atom)